First Look Approval is dedicated to the success of our agents. At the end of the day, if our agents are successful, First Look Approval is successful. That's why we've built this back office training center along with the support materials you see, for YOUR SUCCESS.

When you first begin working with us, it is highly recommended that you review this section FIRST, before studying any of the material available in your back office. This training center was specifically built as a starting point for all new agents, helping to ensure each agent has the knowledge necessary to be successful. Please don't hesitate to contact us if you have questions.

|

|

1. What Is Consumer Finance? |

|

|

|

|

2. What Are The Benefits Of Consumer Finance? |

|

|

|

|

|

|

3. What Is A Discount Rate? |

|

|

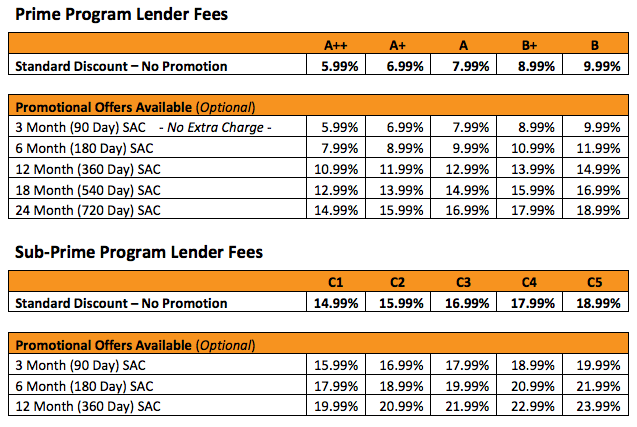

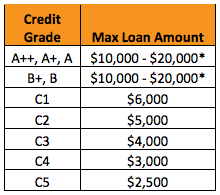

A Discount Rate is completely standard in the consumer finance industry and is the cost of the financing to the merchant (remember, the merchants have no risk on these loans). Wells Fargo, GE, Chase, Citi, CareCredit and every other Consumer Financing program available has a discount rate associated to their program. Our discount rates are competitive to the big banks and vary based upon credit score. Lets look at an example to further understand how this discount rate works. On the Installment Loan program, lets say we are working with a roofing company who has a loan approved for $10,000. Lets assume this loan is for a borrower with B+ credit, meaning there is a discount rate of 8.99% associated with the loan (see discount rate pdfs below). The cost and payout to the merchant for this particular loan would be as follows: |

|

|

|

|

4. Who's Our Main Competition? |

|

|

|

5. What's Our Competitive Advantage? |

|

|

Big Bank Financing

|

VS

|

First Look Approval

|

|

|

|

|

|

|

|

|

6. Details On Our Financing Programs |

|

100% Electronic Installment Loan Program

|

Standard Discount Rates Associated With Program

|

Revolving Credit Card Program

|

Standard Discounts With Program

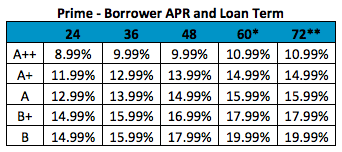

Loan Details For Borrower

|

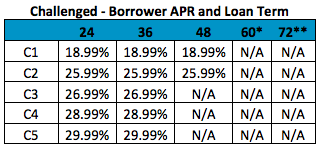

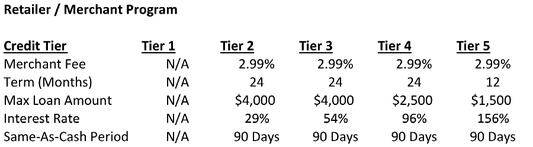

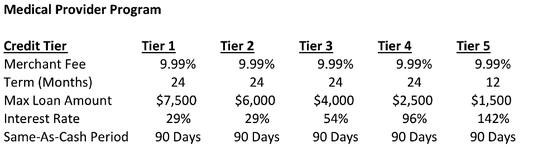

Sub-Prime Financing Program

|

|

|

7. Review The Complete Details On Each Program |

|

|

|

8. Where To Begin As An Agent |

|

|

Agent Getting Started Guide

|

General FAQs

For Agents |

Now that you've gone through the initial training process and have a better understanding of First Look Approval and Consumer Finance in general, you're ALMOST ready to begin.

Before getting started with prospecting for new accounts, please be sure to download and read our Agent Getting Started Guide. This is your ticket to success, detailing step by step what you need to do to begin. Also be sure to read our General FAQs For Agents. Finally, be sure to review in detail the Agent Support Document section of our website. There are many documents and tools available for your success! |

|

The last step to complete before getting started with prospecting is to schedule a training call with First Look Approval's VP of Sales and Marketing, Evan Philippi. Evan will work with you to ensure you understand the most important information that's needed to begin. Evan will additionally be your point of contact ongoing within First Look Approval and will help you whenever needed. Remember, we're here for your success! Don't hesitate to contact us if you need help or have any questions. |

We Look Forward To Working With You!!