|

|

Who Is AvantCredit?

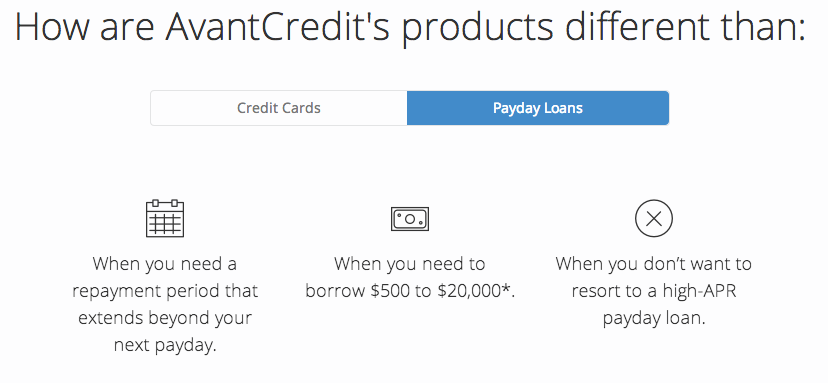

AvantCredit is a consumer lender offering a fast, simple, and secure borrowing experience to consumers with less than perfect credit. Borrowers can apply online for a personal loan ranging from $500 to $20,000. AvantCredit customers can take advantage of competitive APRs with no hidden fees or charges, no collateral, and a completely easy and friendly experience. Founded in 2012, AvantCredit is headquartered in Chicago, IL and offers 24/7 customer support. |

|

|

Program Details

|

|

|

Credit Type Approved: Near-Prime & Sub-Prime

Min FICO Needed: 550 FICO Loan Amounts: $500 - $20,000 Loan Terms: 12 - 48 Months Interest Rates: 25% - 95% Upfront Fees? NO Prepayment Penalties? NO |

Instant Approval? YES

Loan Origination Fee (To Borrower): 0% Time For Customer To Receive Funds: 1-5 Days States NOT Approved: Iowa, Maine, North Dakota, Wyoming, Colorado, Oklahoma, Pennsylvania, Vermont, Massachusetts Notes: Consumers with less than perfect credit can qualify for a loan with Avant Credit. |

|

|

How It Works

|

|

The Following Documentation Is Taken Directly From AvantCredit's

Website And Features Details On How The Loan Process Works.

Website And Features Details On How The Loan Process Works.

What loan products does AvantCredit offer?

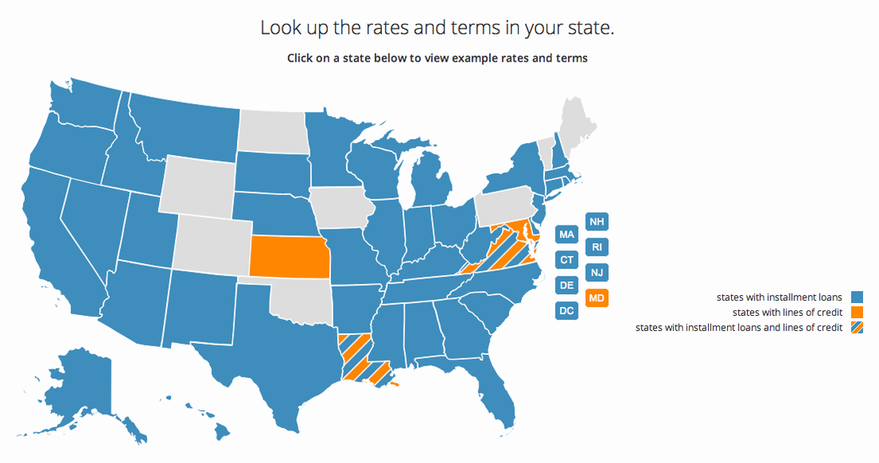

AvantCredit currently offers 2 types of products with availability based on your state of residency.

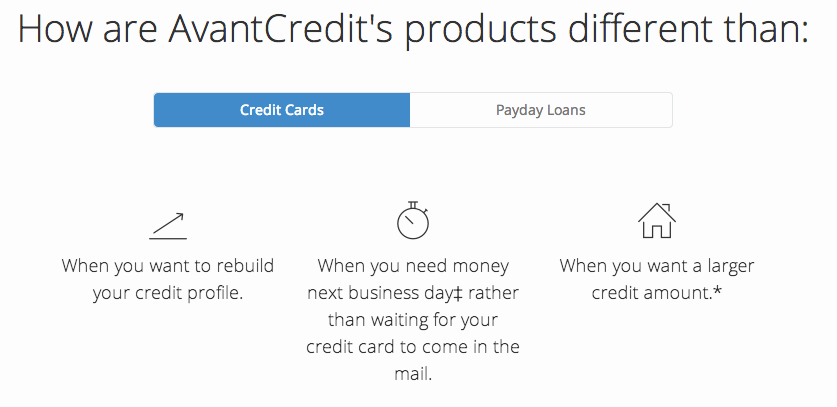

AvantCredit Personal Loan: A standard consumer installment loan with an AvantCredit twist. Like most bank loans, our personal loans amortize over time with simple, equal monthly payments. Plus, enjoy the benefits of late fee forgiveness, a 100% online process, and the potential to improve your credit rating over time!

AvantCredit Credit Line: Our credit line is like a credit card without the card. After you're approved for a credit line, you can access this credit anytime and anywhere, as long as you are connected to the web. Your credit line is always open for you to draw against whenever a need arises! Additionally, enjoy all of the benefits of an AvantCredit Personal Loan, including late fee forgiveness and the ability to improve your credit rating through consistent, successful repayment.

How much can I borrow?

At AvantCredit, we get you the best loan offer available at AvantCredit for your unique financial situation.

We will look at a variety of factors when determining your eligibility, including your credit score and income. Based on this information, you will be able to select your loan amount up to your approved amount or state limit.

What are the fees?

We know loan fees and APRs can be confusing. At AvantCredit, we are committed to a transparent fee structure that makes it easy for you to understand. For our installment loans the only fees you will ever pay is the interest accrued on your loan and late fees if applicable. We'll never charge you hidden loan fees like application fees, membership fees, or prepayment fees. On our personal credit lines we adhere to the same transparency. You will only be charged interest accrued on your loan, and in Maryland a minimum monthly charge will be issued in addition to interest.

Late fees may apply if a scheduled payment is missed, except for residents of Georgia. Amount and time of application of late fee vary by state.

See state map below for rates by approved state

How fast will my loan be funded?

We know this loan is important to you, so we work hard to get it to you quickly, most often the following business day!

- If your application is approved before 5pm Central Time Monday through Thursday, your funds will be deposited in your bank account the next business day.

- If your application is approved between 5pm Central Time Thursday and 7pm Central Time Sunday, you'll receive your funds on Monday.

|

|

Rates By Approved State

|

|

|

|

Approved Industries

|

|

ALL INDUSTRIES QUALIFY TO OFFER AVANTCREDIT.

|

|

Merchant Requirements

|

|

ALL MERCHANTS QUALIFY TO OFFER AVANTCREDIT. THERE ARE NO MINIMUM MERCHANT REQUIREMENTS SINCE EACH LOAN IS FUNDED DIRECTLY TO THE CUSTOMER.

|

|

Additional Links & Materials

|

|