|

|

Who Is LightStream?

LightStream is an online consumer lending division of SunTrust Bank, a Georgia banking corporation. LightStream offers a virtually paperless application, approval, signature, funding and servicing process. Borrowers can apply online and list loan requests ranging from $5,000 to $100,000. They offer fixed rate, simple interest installment loans all with no fees or prepayment penalties. You can set up an account online making monthly payments easy for borrowers to manage. Founded in 1985, SunTrust is headquartered in Atlanta, Georgia. SunTrust has 1,659 bank branches throughout the Southern states. |

|

|

Program Details

|

|

|

Credit Type Approved: SUPER Prime ONLY

Min FICO Needed: 760 FICO Loan Amounts: $5,000 - $100,000 Loan Terms: 24 - 84 Months Interest Rates: 4.99% - 9.99% Fees To Borrower: NONE Prepayment Penalty: NONE |

Instant Approval? YES

Loan Origination Fee (To Borrower): 0% Time For Customer To Receive Funds: 1-5 Days States NOT Approved: Available In All 50 States Notes: Consumers will need to have excellent credit to qualify for this loan. The average credit score approved is 780, showing that only customers with perfect credit will qualify. |

|

|

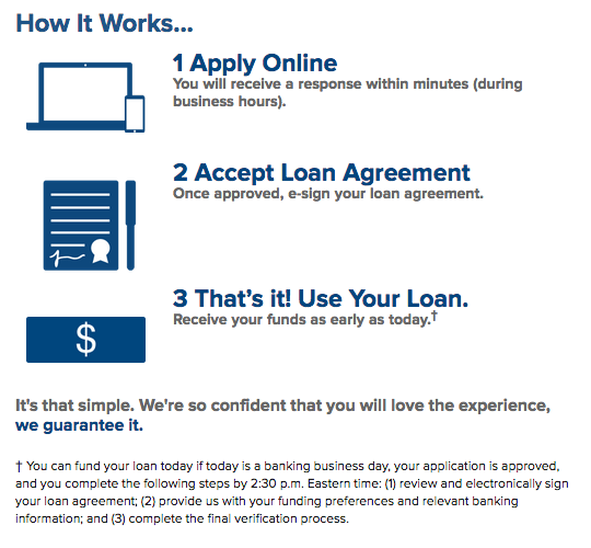

How It Works

|

|

|

|

Approved Industries

|

|

ALL INDUSTRIES QUALIFY TO OFFER LIGHTSTREAM.

|

|

Merchant Requirements

|

|

ALL MERCHANTS QUALIFY TO OFFER LIGHTSTREAM. THERE ARE NO MINIMUM MERCHANT REQUIREMENTS SINCE EACH LOAN IS FUNDED DIRECTLY TO THE CUSTOMER.

|

|

Additional Links & Materials

|

|