|

|

Who Is Prosper?

Prosper is America's first peer-to-peer lending marketplace, with more than 2 million members and over $1,000,000,000 in funded loans. Prosper allows people to invest in each other in a way that is financially and socially rewarding. On Prosper, borrowers list loan requests between $2,000 and $35,000 and individual lenders invest as little as $25 in each loan listing they select. In addition to credit scores, ratings, and histories, investors can consider borrowers’ personal loan descriptions, endorsements from friends, and community affiliations. Prosper handles the servicing of the loan on behalf of the matched borrowers and investors. |

|

|

Program Details

|

|

|

Money Funds To: CONSUMER

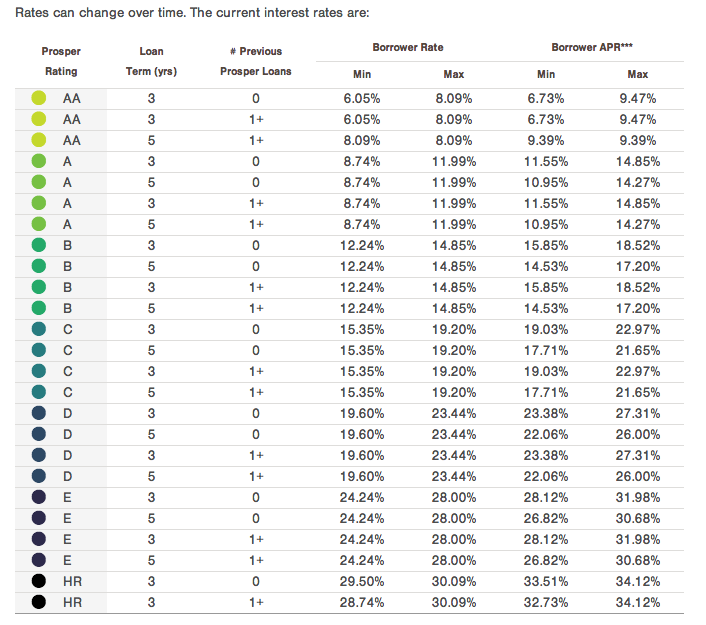

Credit Type Approved: Prime & Near-Prime Min FICO Needed: 640 FICO Loan Amounts: $2000 - $35,000 Loan Terms: 36 or 60 Months Interest Rates: 6% - 36% Prepayment Penalty? NO Upfront Fees? NO |

Instant Approval? YES

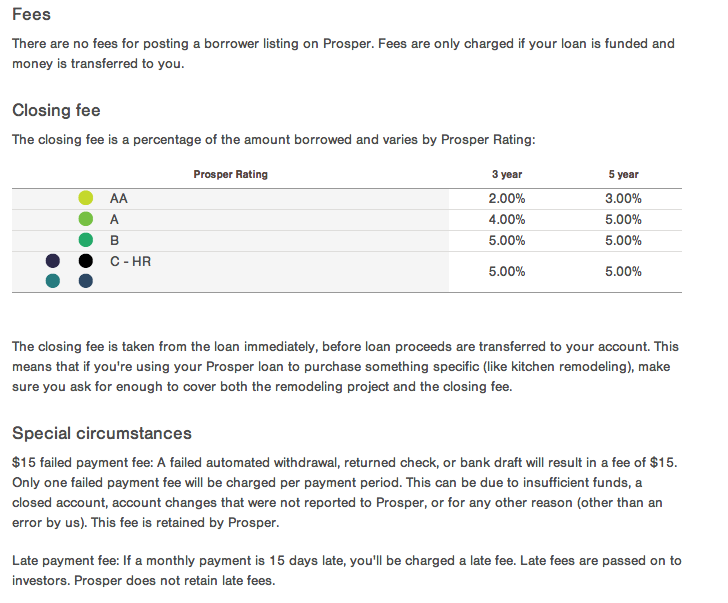

Loan Type: Unsecured Installment Loan (No Collateral Needed) Loan Origination Fee (To Borrower): 2-5% Time For Customer To Receive Funds: 1-5 Days States NOT Approved: Iowa, Maine, North Dakota Notes: Consumers with good and excellent credit will qualify for Prosper. While credit score is not the only factor considered for an approval, Prosper will approve more customers than a bank. |

|

|

How It Works

|

|

The Following Documentation Is Taken Directly From Prospers

Website And Explains How Your Customer Will Obtain A Loan.

Website And Explains How Your Customer Will Obtain A Loan.

1. Create your loan listing

Creating a loan listing on Prosper is easy and typically takes only 15-20 minutes.

The steps include:

If you qualify, you will be presented with an interest rate and corresponding monthly payments based on the requested loan amount—plus some alternatives for lower rates or lower payments.

What’s the difference between a listing and a loan?

A listing is your request for a loan and will be viewed by potential investors. You will receive a loan if investors commit sufficient funds to your listing and your information has passed Prosper's verification process.

2. Investors commit funds to your loan

Once your listing is active on Prosper, investors will be able to view your listing and can start investing in your loans. This means depending on your loan amount, you may have dozens of individual investors. You can see the progress of your loan funding commitments at any time, by returning to Prosper and going to My Account.

The listing will stay active until either it has received sufficient investor commitments or the 14-day listing period ends. If it does not receive at least the minimum required level of investor commitments within the 14-day period, no loan will be made. If you want to try again, you can do so by creating a new listing.

What happens while I wait for investors to commit to fund my loan?

You’ll receive an email asking for specific loan verification documents – including your driver’s license, address verification, bank statement, and a W-2, when applicable. Getting these documents to Prosper often speeds up how fast investors commit to invest in your loan.

3. Receive your money

Once your listing has received sufficient investor commitments and the verification process is complete, the loan proceeds will be deposited directly into your bank account. This usually only takes a few days.

How long does the borrowing process take?

The average borrower has the loan proceeds deposited into their account within 8 days of submitting their application.

4. Make monthly payments

Prosper will make monthly automatic withdrawals from your bank account in the amount of your agreed-upon monthly loan payment. If you choose, you may make an optional additional loan payment or pay off your loan early without any penalty fees.

Creating a loan listing on Prosper is easy and typically takes only 15-20 minutes.

The steps include:

- Give us some basic information about yourself

- Check your rate and review your loan options

- Finalize your listing with a description of your loan purpose and your financial situation

If you qualify, you will be presented with an interest rate and corresponding monthly payments based on the requested loan amount—plus some alternatives for lower rates or lower payments.

What’s the difference between a listing and a loan?

A listing is your request for a loan and will be viewed by potential investors. You will receive a loan if investors commit sufficient funds to your listing and your information has passed Prosper's verification process.

2. Investors commit funds to your loan

Once your listing is active on Prosper, investors will be able to view your listing and can start investing in your loans. This means depending on your loan amount, you may have dozens of individual investors. You can see the progress of your loan funding commitments at any time, by returning to Prosper and going to My Account.

The listing will stay active until either it has received sufficient investor commitments or the 14-day listing period ends. If it does not receive at least the minimum required level of investor commitments within the 14-day period, no loan will be made. If you want to try again, you can do so by creating a new listing.

What happens while I wait for investors to commit to fund my loan?

You’ll receive an email asking for specific loan verification documents – including your driver’s license, address verification, bank statement, and a W-2, when applicable. Getting these documents to Prosper often speeds up how fast investors commit to invest in your loan.

3. Receive your money

Once your listing has received sufficient investor commitments and the verification process is complete, the loan proceeds will be deposited directly into your bank account. This usually only takes a few days.

How long does the borrowing process take?

The average borrower has the loan proceeds deposited into their account within 8 days of submitting their application.

4. Make monthly payments

Prosper will make monthly automatic withdrawals from your bank account in the amount of your agreed-upon monthly loan payment. If you choose, you may make an optional additional loan payment or pay off your loan early without any penalty fees.

|

|

The Verification Process

|

|

The Following Documentation Is Taken Directly From Prospers Website And Explains The Verification Process Your Customer Will Go Through

How to complete your loan faster

Use Verification Stage to track progress— and submit information promptly.

How does Prosper verify my information?

Prosper verifies the identity of every borrower member who requests a loan through our social lending system. Depending on the loan request, we may also ask for documents proving employment and sources of income.

We use a variety of sources and methods including credit bureau data, other electronic data, and standard verification procedures. If a borrower member is unable to provide sufficient documentation to verify information key to evaluating the borrower's application, we will cancel the loan request and close the application.

What is Prosper's Verification Stage?

The Verification Stage indicates the progress on your Prosper loan application, based on Prosper's verification of information and documents you've submitted. Verification Stage icons tell you and prospective investors how far along Prosper is in verifying the information you submitted, in order to process your application. The higher the Verification Stage, the more attractive your listing is to investors. You can help improve the Verification Stage to get your loan application completed sooner—and your money faster—by submitting required documents promptly upon request.

The Verification Stage of your loan is represented by one of the icons shown below, which appears next to your loan listing on your My Accounts page. Investors can also see your loan's Verification Stage within your Listing Summary, Browse Listings and search results pages.

Verification Stage 1

The borrower needs to submit documentation for Prosper to verify. The further along in verification, the higher the Verification Stage and the more likely the loan will originate. The borrower can advance to a higher Verification Stage by promptly submitting requested documents.

Verification Stage 2

Prosper has verified some information provided by the borrower, but there are still items pending verification. The further along in verification, the higher the Verification Stage and the more likely the loan will originate. The borrower can advance to a higher Verification Stage by promptly submitting requested documents.

Verification Stage 3

Prosper has verified most of the information provided by the borrower. Additional documentation may still be required, but loans in Verification Stage 3 are very likely to originate.

Remember: You can improve your Verification Stage

Keep an eye out for messages from Prosper regarding information and document requests, and submit your answers or documents as soon as possible. The faster you advance your Verification Stage, the faster you can get your money. Loans that reach Verification Stage 3 are 63% more likely to originate.

Does reaching Verification Stage 3 guarantee that I'll receive a loan?

Reaching Verification Stage 3 only indicates that Prosper has verified most of the information and documents you have submitted and does not guarantee that your loan will be funded. But, the sooner your loan reaches Verification Stage 3, the sooner Prosper can complete processing, and the more likely it will be that the loan will originate.

Is my loan application complete when it reaches Verification Stage 3?

Your loan application process is not necessarily complete when you reach Verification Stage 3; we may need more documentation. And please note that your Verification Stage can go backward if during our review we discover that we need additional information. For example, if we can only verify partial income for the year, we may have to request additional documents for a full year's income.

How is the Verification Stage different from the Prosper Rating?

The Prosper Rating is a proprietary system used to maintain consistency when evaluating each loan application. Prosper Ratings allow potential investors to easily consider your loan application's level of credit risk because the rating represents an estimated average annualized loss rate range. Learn more aboutProsper Ratings.

In contrast, the Verification Stage is not a measure of potential credit risk. It is an indication of the progress of your loan application based on verification of required information and documents. Since the Verification Stage lets you know where your loan application stands in the verification process, consider it a helpful reminder to submit documents promptly, which will help you get your money faster.

Use Verification Stage to track progress— and submit information promptly.

How does Prosper verify my information?

Prosper verifies the identity of every borrower member who requests a loan through our social lending system. Depending on the loan request, we may also ask for documents proving employment and sources of income.

We use a variety of sources and methods including credit bureau data, other electronic data, and standard verification procedures. If a borrower member is unable to provide sufficient documentation to verify information key to evaluating the borrower's application, we will cancel the loan request and close the application.

What is Prosper's Verification Stage?

The Verification Stage indicates the progress on your Prosper loan application, based on Prosper's verification of information and documents you've submitted. Verification Stage icons tell you and prospective investors how far along Prosper is in verifying the information you submitted, in order to process your application. The higher the Verification Stage, the more attractive your listing is to investors. You can help improve the Verification Stage to get your loan application completed sooner—and your money faster—by submitting required documents promptly upon request.

The Verification Stage of your loan is represented by one of the icons shown below, which appears next to your loan listing on your My Accounts page. Investors can also see your loan's Verification Stage within your Listing Summary, Browse Listings and search results pages.

Verification Stage 1

The borrower needs to submit documentation for Prosper to verify. The further along in verification, the higher the Verification Stage and the more likely the loan will originate. The borrower can advance to a higher Verification Stage by promptly submitting requested documents.

Verification Stage 2

Prosper has verified some information provided by the borrower, but there are still items pending verification. The further along in verification, the higher the Verification Stage and the more likely the loan will originate. The borrower can advance to a higher Verification Stage by promptly submitting requested documents.

Verification Stage 3

Prosper has verified most of the information provided by the borrower. Additional documentation may still be required, but loans in Verification Stage 3 are very likely to originate.

Remember: You can improve your Verification Stage

Keep an eye out for messages from Prosper regarding information and document requests, and submit your answers or documents as soon as possible. The faster you advance your Verification Stage, the faster you can get your money. Loans that reach Verification Stage 3 are 63% more likely to originate.

Does reaching Verification Stage 3 guarantee that I'll receive a loan?

Reaching Verification Stage 3 only indicates that Prosper has verified most of the information and documents you have submitted and does not guarantee that your loan will be funded. But, the sooner your loan reaches Verification Stage 3, the sooner Prosper can complete processing, and the more likely it will be that the loan will originate.

Is my loan application complete when it reaches Verification Stage 3?

Your loan application process is not necessarily complete when you reach Verification Stage 3; we may need more documentation. And please note that your Verification Stage can go backward if during our review we discover that we need additional information. For example, if we can only verify partial income for the year, we may have to request additional documents for a full year's income.

How is the Verification Stage different from the Prosper Rating?

The Prosper Rating is a proprietary system used to maintain consistency when evaluating each loan application. Prosper Ratings allow potential investors to easily consider your loan application's level of credit risk because the rating represents an estimated average annualized loss rate range. Learn more aboutProsper Ratings.

In contrast, the Verification Stage is not a measure of potential credit risk. It is an indication of the progress of your loan application based on verification of required information and documents. Since the Verification Stage lets you know where your loan application stands in the verification process, consider it a helpful reminder to submit documents promptly, which will help you get your money faster.

|

|

Approved Industries

|

|

ALL INDUSTRIES QUALIFY TO OFFER PROSPER.

|

|

Merchant Requirements

|

|

ALL MERCHANTS QUALIFY TO OFFER PROSPER. THERE ARE NO MINIMUM MERCHANT REQUIREMENTS SINCE EACH LOAN IS FUNDED DIRECTLY TO THE CUSTOMER.

|

|

Additional Links & Materials

|

|