|

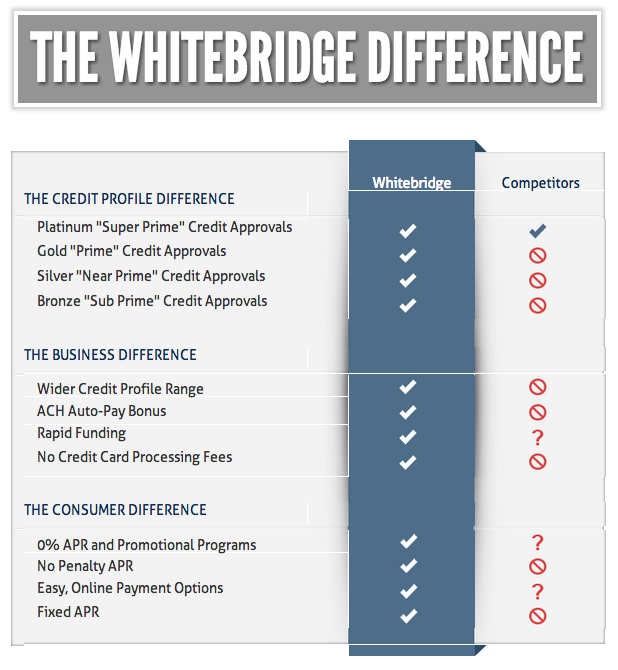

Who Is Whitebridge Financial? Whitebridge Financial provides diverse consumer finance and service solutions throughout the continental United States. Whitebridge is comprised of a team of professionals who have a combined experience of over 50 years in the finance industry. They have the capital and resources to meet large dealers’ volume and growth expectations, regardless of size or volume. Whitebridge Financial provides a wider range of credit approvals, generating the highest acceptance rate possible; ultimately leading to increased cash flow for your business by expanding your customer base. Whitebridge Financial is focused is on being different from a traditional “super-prime only” financing source. Whitebridge has a unique underwriting process and proprietary credit models that allow them to accurately gauge and classify consumers’ risk; enabling them to approve more of your customers. When working with Whitebridge Financial, they'll become an extension of your business. Whitebridge Financial strives to provide the highest level of personalized service for both dealers and consumers alike. |

|

|

Program Details

|

|

|

|

Dealer Portal and Digital Documents

Whitebridge offers online approvals, couples with real-time electronic contract generation, as well as document tracking solutions thorough our online Dealer Portal. Our Dealer Portal enables clients to prepare electronic contracts, close sales, and execute agreements from anywhere in the continental US.

Whitebridge Digital Documents is our online platform that provides document preparation methods of executing credit agreements. Our Digital Docs process allows you to efficiently close deal and avoid inaccuracies.

Our Dealer Portal and Digital Documents Enable You to:

Our Digital Document system enables you to close transactions digitally across the US.

Whitebridge Digital Documents offers several options that are flexible in order to meet your specific requirements.

Utilizing Whitebridge Digital Docs through our online Dealer Portal gives you the ability to track the flow of your credit applications and E-docs in real time.

When you choose Whitebridge, you streamline your sales process, reduce errors, and increase your sales volume.

Whitebridge offers online approvals, couples with real-time electronic contract generation, as well as document tracking solutions thorough our online Dealer Portal. Our Dealer Portal enables clients to prepare electronic contracts, close sales, and execute agreements from anywhere in the continental US.

Whitebridge Digital Documents is our online platform that provides document preparation methods of executing credit agreements. Our Digital Docs process allows you to efficiently close deal and avoid inaccuracies.

Our Dealer Portal and Digital Documents Enable You to:

- Streamline your sales process

- Input customer applications

- Receive an immediate decision

- Communicate with Whitebridge

- Calculate payments

- Track approvals and contact status online, in real time

- Lower your costs and improve accuracy

- Virtually eliminate paperwork

Our Digital Document system enables you to close transactions digitally across the US.

Whitebridge Digital Documents offers several options that are flexible in order to meet your specific requirements.

- You can prepare and print agreements for a manual signature,

- You can prepare applications and contacts electronically, and email them to your customers for digital acceptance and digital signature.

Utilizing Whitebridge Digital Docs through our online Dealer Portal gives you the ability to track the flow of your credit applications and E-docs in real time.

When you choose Whitebridge, you streamline your sales process, reduce errors, and increase your sales volume.

|

|

Approved Industries

|

|

|

Consumer Goods

Medical Services Medical Device General Goods & Services Beds & Bedding Camping and Resorts Career Development Dental |

Home Improvement

Jewelry Funeral Educational Programs Furniture Lasik Orthodontics And More... |

|

|

Merchant Requirements

|

|

1. Merchant Must Be In Business For At Least 2 Years

2. Business Owner Must Have A 600+ FICO

3. Merchant Must Do At Least $5,000,000 Per Year In Gross Revenue

4. Merchant Must Have NO PRIOR BANKRUPTCIES

2. Business Owner Must Have A 600+ FICO

3. Merchant Must Do At Least $5,000,000 Per Year In Gross Revenue

4. Merchant Must Have NO PRIOR BANKRUPTCIES

|

|

Merchant Enrollment Process

|

|

- Dealer completes a Whitebridge application

- Dealer provides required business information

- Whitebridge approves the dealer application

- Whitebridge generates a dealer agreement

- Dealer reviews and signs the dealer agreement

- Whitebridge sets up dealer in our Dealer Portal

- Whitebridge provides system and process training to the dealer’s employees

|

|

Support Documents

|

|

|

WhiteBridge

Helpful Hints |

How To Process A Loan

|

Credit Application

|

WhiteBridge FAQs

|